Download, customise and send our free sole trader, self-employed, and freelance invoice template in minutes, or make self-employed invoicing even faster with Crunch Free.

Free resources for your business

There’s nothing quite like the freedom of being your own boss. With our free invoice templates for sole traders, the self-employed, and freelancers, you can make sure you get paid for all your hard work.

Download a blank invoice template in your preferred format below, then customise the details to make it your own. If you want to save even more time on invoicing, instead you can sign up for Crunch’s free accounting software.

How to use our sole trader, self-employed, and freelance invoice template

If you’re a freelancer or independent contractor, you probably spend a lot of time tracking down new clients and pitching for work. If you’re juggling two or three jobs on any given day, invoicing is the last thing you want to be doing.

But what’s the point of winning all that work if you aren’t getting paid for it?

With our self-employed contractor invoice template, you can download, customise and send invoices to your clients in minutes.

Let’s dive into the details so you know exactly how to set up your invoice template for your business.

Here’s how you can create a master invoice template in three quick steps:

Duplicate your master invoice to create and send new invoices

Now that your master invoice is set up, it’s time to start sending it out to your clients so you can get yourself paid.

Here’s how you can duplicate and send new invoices in five easy steps:

Here’s everything you’ll need to edit for each invoice:

- A unique invoice number

- Your customer’s name

- Your customer’s address

- A breakdown of the products or services you’re charging them for

- The cost or rate for each product or service

- The total amount due

If you’re VAT-registered, you’ll also need to include:

- Your VAT registration number

- The net cost of the products or services you’re charging them for

- The VAT rate of each product or service

- The subtotal, excluding VAT

- The total amount of VAT being charged

Frequently asked questions

Explore our FAQs for quick answers to your questions

Yes, you need to invoice your customers and clients. This is so you can outline the costs for your products or services and request payment. Without an invoice, your client’s finance department won’t know who to pay, how much to pay or where to send the money.

Crunch offers a range of free invoice templates for hours worked in the UK. If you go for our templates for Microsoft Excel or Google Sheets, you can add custom formulas to your template. So if you or your employees work on a fixed hourly rate, you can work out your pay in seconds and make sure that you’re charging the right amount for your work.

Invoicing is simple. Download one of our invoice templates and customise the details to suit you. You’ll need to include information about your business and your client, plus the products or services you’re charging them for. Then you just need to export a PDF and send it off.

You can create an invoice by downloading one of our blank invoice templates. Available for Microsoft Word, Microsoft Excel, Google Docs, and Google Sheets, you’re free to choose the template that suits you and your business. But, if you prefer a pen-and-paper approach, you can go for our printable PDF VAT registered limited company invoice template instead.

It’s common to include payment terms of 30 days on their invoices. This is because most companies take care of payroll on a monthly basis. So even if you complete your work on the first of the month, your client should be able to pay you by the end of that month. If you still haven’t been paid after 30 days, it’s probably time to start asking some questions.

Still have questions?

Connect your bank account

Software & service in one

We actively support your business by managing deadlines, advising on tax relief, assisting with registrations, and liaising with HMRC. Our commitment extends beyond tasks, focusing on delivering quality work and proactive accounting advice tailored to your needs.

Software Features

Create & Send Invoices

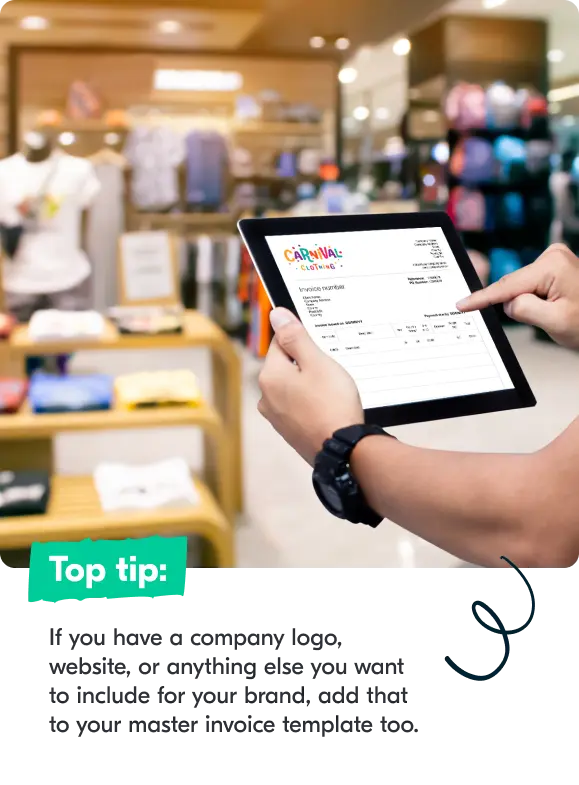

Create invoices and send on the go. Send custom and unlimited invoices from your laptop, smartphone or tablet in just a few clicks.

Expense Management

Say goodbye to inputting data manually. Save time by automating and tracking your expenses. Scan receipts and claim straight away.

Bank Reconciliation

Keep your financials up to date by easily matching up your expenses and invoice payments through bank reconciliation.

Open Banking

Connect your bank and import your statements to reconcile transactions. Transactions go straight to Crunch each week.

Reporting

Get custom reports and insights in real time with Brixx, to help you keep on top of your cash flow and support you on future business decisions.

Upload Bank Statement

Streamline your financial tracking and analysis by effortlessly importing your financial data for a comprehensive overview of your accounts.

Discover our accounting software, designed to intuitively fit into your daily financial routines. Experience the harmony of efficiency and simplicity on your financial journey.

.svg)