It just adds up

We figure that Crunch is unique within the UK accountancy software market. We built Crunch Free to self-employed help professionals grow their business, without the high costs of accounting software and accountancy fees. We deliver features and functions to allow you to take maximum control of your business finances.

Crunch is the only online UK accounting company with a free accounting software app

Crunch delivers many features and functions that our rivals cannot provide

Only Crunch offers free UK accounting software for Limited and Small Businesses

We are unique in the UK by supplying qualified accountants in-house

Count on Crunch for free software

Integrations - Easily connect to a range of helpful business

Financial forecasting, reporting for cash flow, business planning and budgeting for your business.

Take a photo of your expense receipt, show how you paid for it and then submit it to Snap to process it. It’s as easy as that. Snap Lite is free to use for all Crunch users.

If you’re VAT registered on the standard rate scheme, Tripcatcher will calculate your VAT on your fuel costs so that you can claim the right amount of expenses.

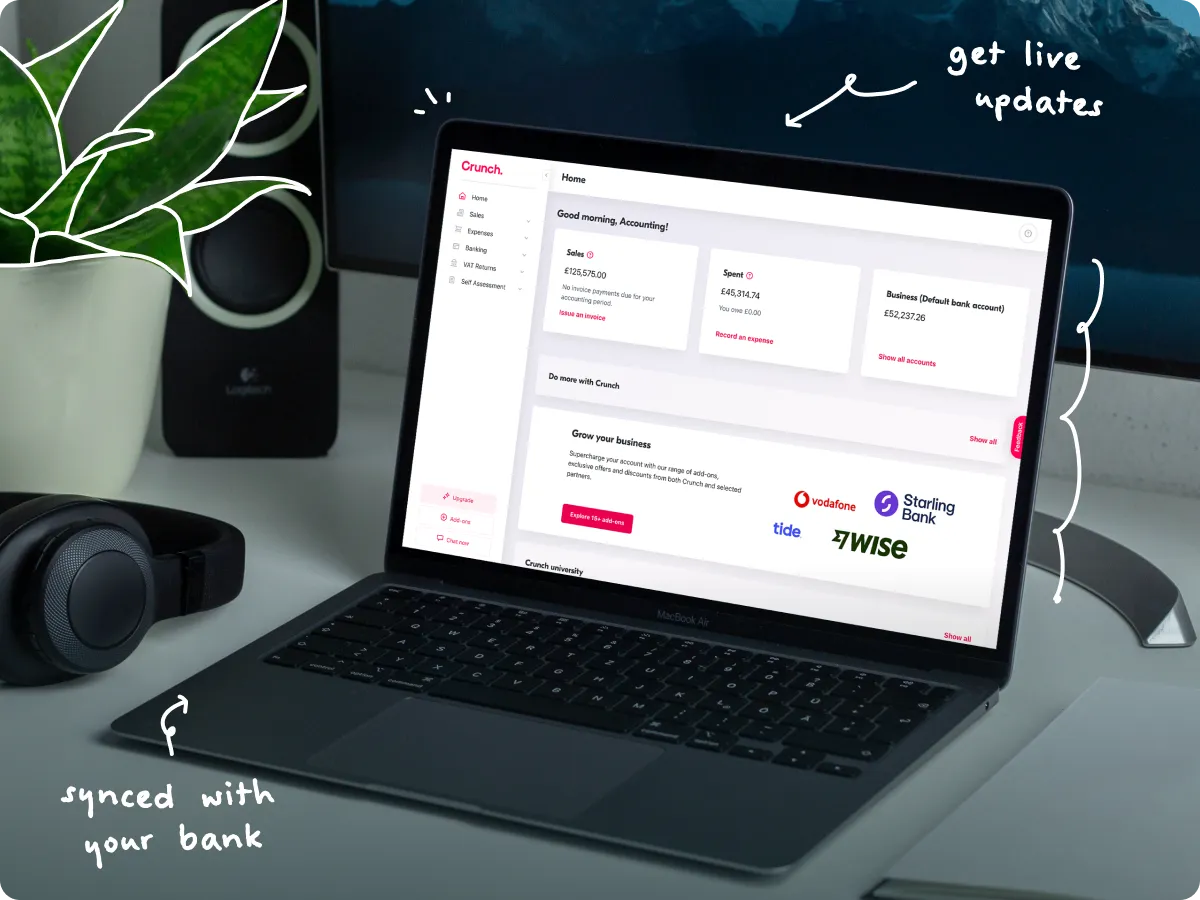

Open banking will pull through your transactions from your business bank account to your Crunch account.

Compare Crunch with the competition. We have secured the best deal for you

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Unlimited support from Chartered Certified Accountants at your fingertips.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

Take the stress out of your personal tax return.

No one else provides a completely free-of-charge platform like Crunch.

Our competitors do offer a free short-term trial before a monthly fee is required to use their software as well as find and pay for a separate accountant.Crunch Free accounting software for the self-employed will forever equip professionals for free. Support from real accountants we’re a simple, affordable upgrade away.

Loved by many businesses in the UK

Who We Help

Whatever your passion is...

Related Articles

Helpful resources

Looking for accounting software advice and guidance before paying for our service? We've got you covered.

Software & service in one

We actively support your business by managing deadlines, advising on tax relief, assisting with registrations, and liaising with HMRC. Our commitment extends beyond tasks, focusing on delivering quality work and proactive accounting advice tailored to your needs.

Software Features

Create & Send Invoices

Create invoices and send on the go. Send custom and unlimited invoices from your laptop, smartphone or tablet in just a few clicks.

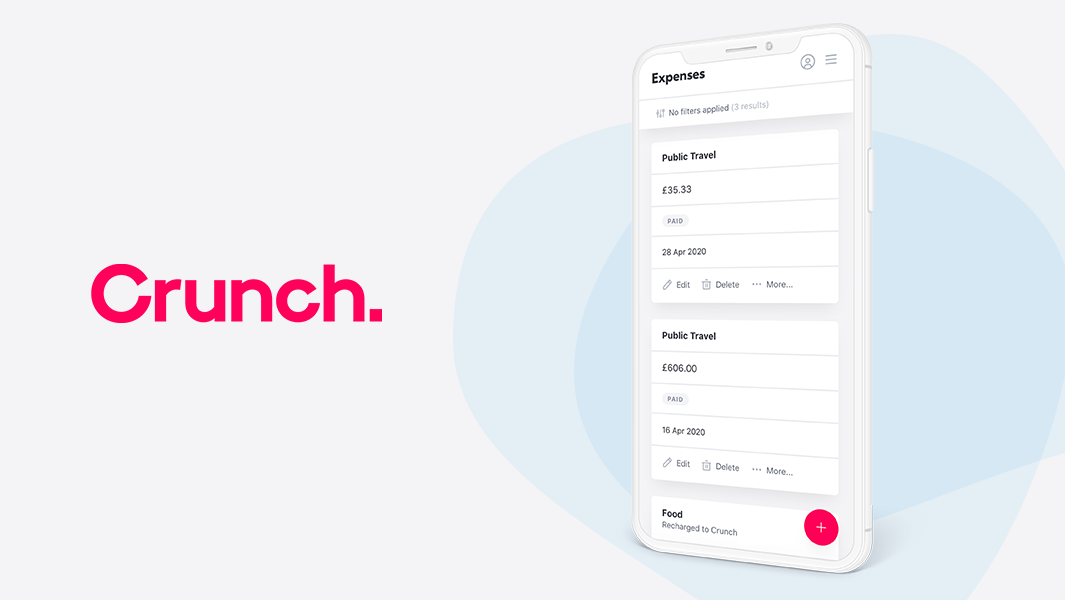

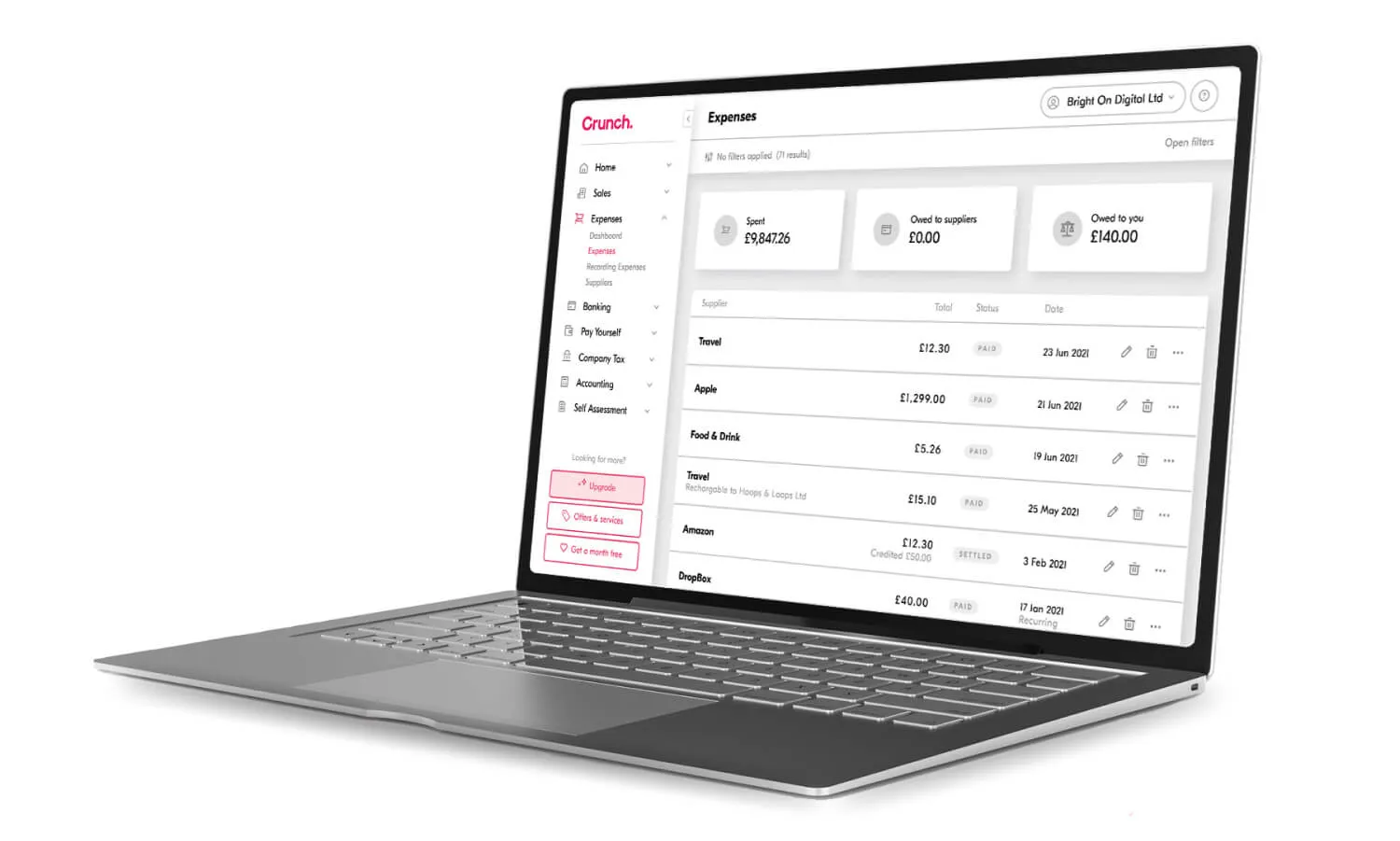

Expense Management

Say goodbye to inputting data manually. Save time by automating and tracking your expenses. Scan receipts and claim straight away.

Bank Reconciliation

Keep your financials up to date by easily matching up your expenses and invoice payments through bank reconciliation.

Open Banking

Connect your bank and import your statements to reconcile transactions. Transactions go straight to Crunch each week.

Reporting

Get custom reports and insights in real time with Brixx, to help you keep on top of your cash flow and support you on future business decisions.

Upload Bank Statement

Streamline your financial tracking and analysis by effortlessly importing your financial data for a comprehensive overview of your accounts.

Discover our accounting software, designed to intuitively fit into your daily financial routines. Experience the harmony of efficiency and simplicity on your financial journey.

Service Features

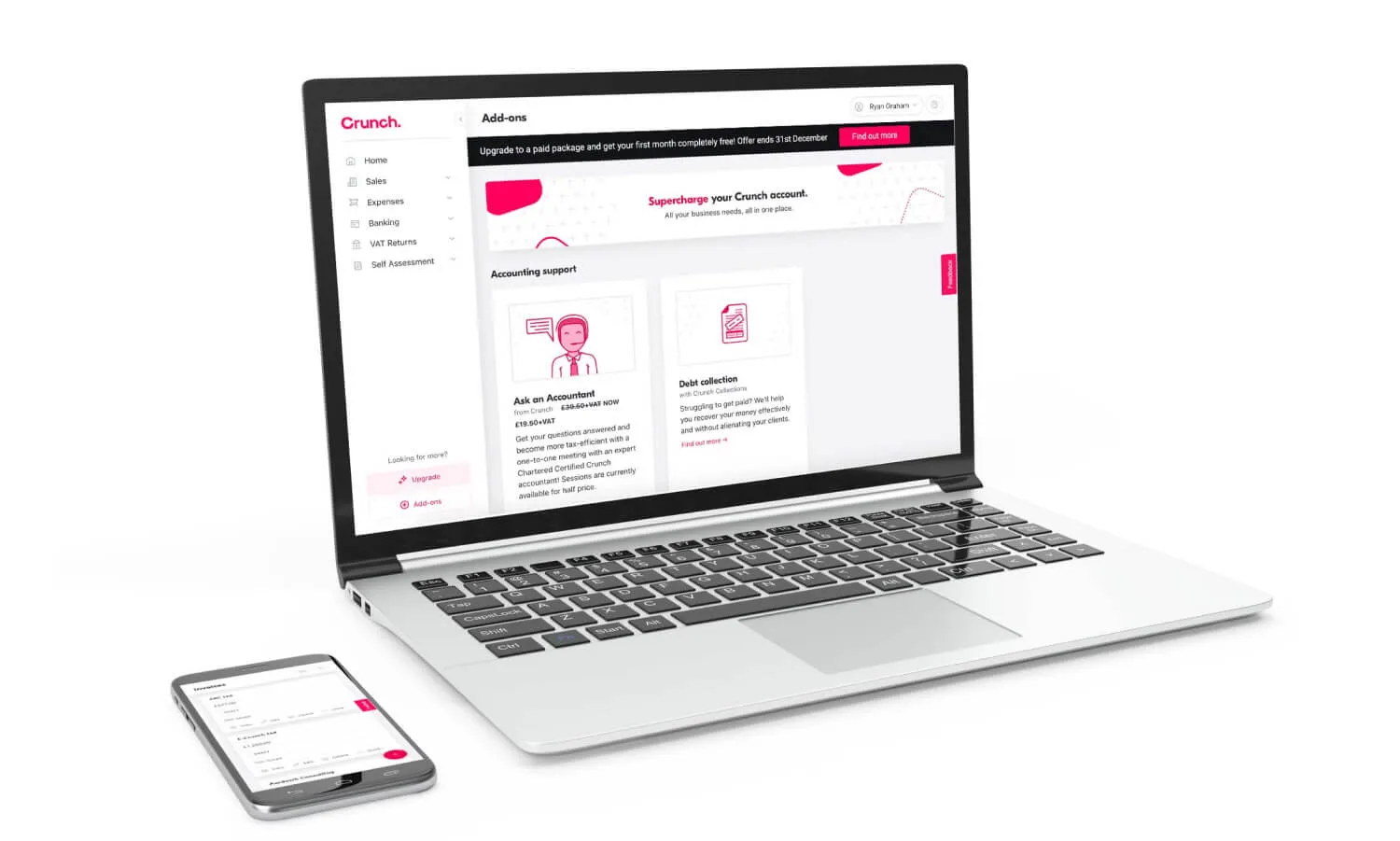

Ask an Accountant

Qualified accountants providing users with instant access to accounting expertise for financial clarity and informed decision-making

VAT Submission

Easily submit & file your VAT return to HMRC. Crunch files returns through HMRC compatible software (Making Tax Digital) every quarter.

Year End Accounts

Effortlessly finalise your fiscal year with our expert year-end accounting solutions, guaranteeing precision and punctuality in every submission.

Crunch Live

Our live video service, where you can speak to our friendly client managers or accountants at a time that works for you.

Payroll

Streamline your payroll process with our efficient solutions, guaranteeing timely payments and complete compliance every pay cycle

Bookkeeping

Our bookkeeping service keeps your accounts up to date and free up your time to do what you do best - managing your business with our Certified Chartered Accountants on hand.

Delve into our accounting services where meticulous care meets a touch of warmth. We're here to illuminate your businesses path with financial precision.

.svg)

.jpg)

.jpg)

.jpg)

.jpg)