Whether it’s to increase their kudos in the contractor community or to improve their bottom line, every contractor wants to be known as a consultant. Whatever their motivation, the term consultant is a highly sought-after title – and for good reason.

Successful marketing is all about packaging yourself and doing it well.

Calling yourself a consultant or a contractor isn’t about semantics. Consulting and contracting aren’t the same thing. Their differences can have a huge impact on your prestige – and your pay packet.

Consulting and contracting defined

While the terms aren’t mutually exclusive, the role of a consultant is, in general, to evaluate their clients’ needs and provide them with expert advice on what work needs to be done. Whereas a contractor’s role is often to carry out the work itself.

Essentially, consultants are paid for their knowledge, contractors for their work.

This is something of a broad-brush contrast, but it does provide an illustration of how consulting can be distinguished from contracting. Here are some of the finer details.

Consultants

A consultant is typically a self-employed, seasoned professional who brings to the table bags of knowledge, skills, and training in their area of expertise.

They’re drafted in when a client has a pressing issue that they neither have the time nor the capacity to resolve. Exercising their independence and professional judgement, a consultant then does whatever they see fit to deliver a solution that meets the client’s needs.

A consultant often works in an advisory capacity. In return for a fixed fee, they carry out an assessment of an entire business or a particular business area and make suggestions about how to make improvements.

So, more often than not, a consultant won’t actually get involved in the daily grind of making the improvements needed. Instead, they advise their client on how best to implement their recommendations.

Contractors

Much like a consultant, a contractor tends to be a skilled, self-employed professional.

Clients pay for their services on a contract basis usually for a fixed period of time. A contractor may work onsite at their client’s premises and they may do so under direct supervision, if they’re also they’re told what to do, how to do it and when it needs to be done then they need to consider the impact of IR35 rules as they could be deemed an employee.

Although a contractor can (and often does) advise their client on what work should be done, their main focus is on getting the work done.

Impact on fees

The importance of the consultant / contractor distinction lies in the power of perception and how that can affect the level of fees you can charge your client.

While a consultant typically advises their client’s business at an executive level, a contractor may be viewed as somewhat subordinate – part of the workforce furniture, if you will. Consequently, a consultant can generally attract higher fees than a contractor. Rather than just offering their time to their client, a consultant markets solutions to their client’s problems and this is reflected in their fees.

For instance, a contractor issues their clients with invoices exclusively based on their time spent providing services – whether this is calculated hourly, daily or project-based. By contrast, a consultant invoices their clients based on the quality of the solution and the consumer demand for it – not solely the time spent providing their services.

How to make progress as a consultant or contractor

The most valuable consultants have insights and skills across their area of expertise and stay abreast of industry developments.

Spend some time learning about evolving concepts and theoretical approaches to problems without getting weighed down by the ins and outs of the practical execution.

Your grand plan should be to find out why certain things work and others don’t. For example, as a brand consultant working on a client’s logo, you may need to swot up on consumer psychology to understand how consumers respond to different colours. Knowing about the importance of a seemingly minor detail like this could mean the difference between your client’s customers browsing their products or services and buying them.

As a contractor, your task is a lot more straightforward. All you need is the ability to do the job you’re contracted to do.

Occasionally, you may get a chance to crossover from contracting to consulting. Opportunity knocks when a client brings you onboard as a contractor but has precious little idea of exactly what it is they need you to do.

This is your chance to shine by volunteering advice that would ordinarily fall within the remit of a consultant. Whilst you may not get paid for the advisory aspect, it could give you a wealth of experience and put you in good stead for nailing a consulting role in the future (if that’s what you’re after).

Irrespective of whether you call yourself a consultant or a contractor, a client will ultimately hire you on merit. But if you position yourself as a consultant by providing tailored solutions for your client’s pain points, you could ease your way to a much higher fee.

Let Crunch free up your time

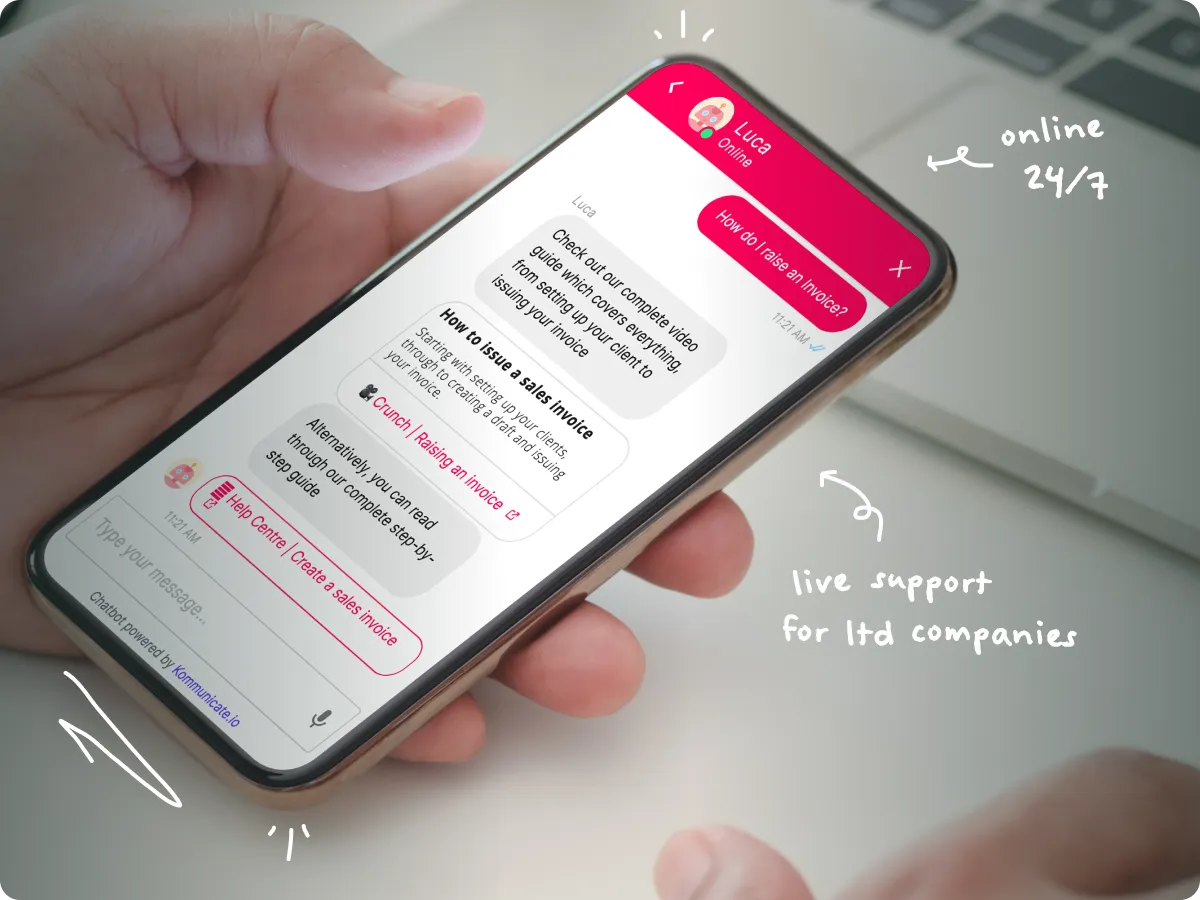

Ultimately, whether you’re a consultant or a contractor you’ll want to spend your time focussing on your clients. So, why not let Crunch help you take care of your business finances?

Our accounting for contractors service makes it easy for you to invoice your clients, get a real-time view of your company’s performance and take care of HMRC and Companies House. Get in touch today for your free consultation.

.svg)

.jpg)

.jpeg)