The UK has many different tax rates, thresholds and allowances affecting individuals and businesses. As a business owner, you’ll be affected by many of them.

As well as the actual tax rates, your personal finances could be affected by the government’s annual changes to tax bands and allowances each tax year. All of this information is published on the Gov.uk site before a new tax year starts. At Crunch, we always publish an article that highlights the main changes for each tax year and how they’ll affect the self-employed.

The tax rates, tax brackets, and tax thresholds also differ depending on where you live in the UK. The Scottish Parliament sets its own income tax rates and thresholds for Scotland. The Welsh Assembly has said that it may introduce its own tax rates and tax brackets in the future for Wales, though, for the 2022/23 and 2023/24 tax years, they remain the same as England and Northern Ireland.

Working out your income and minimising your tax bill by using all the allowances and tax relief available can be tricky with a tax system as complex as the UK’s! Check out our take-home pay calculator to get a quick answer on how different business structures can affect the tax you pay. You can also download our Crunch Personal Tax Estimator to get a more detailed breakdown of the personal tax you may need to pay if you’re employed, self-employed or a combination of both. We've also provided more information for specialist tax obligations, including our guide on the tax relief provisions for charity donations.

{{cta-limited-company}}

UK tax rates, tax thresholds, and tax brackets

Tax rates and thresholds for the 2022/23 and 2023/24 tax years are shown below. We’ve split them into Personal and Company tax rates – you can use the links to jump to the relevant section.

Need accounting help?

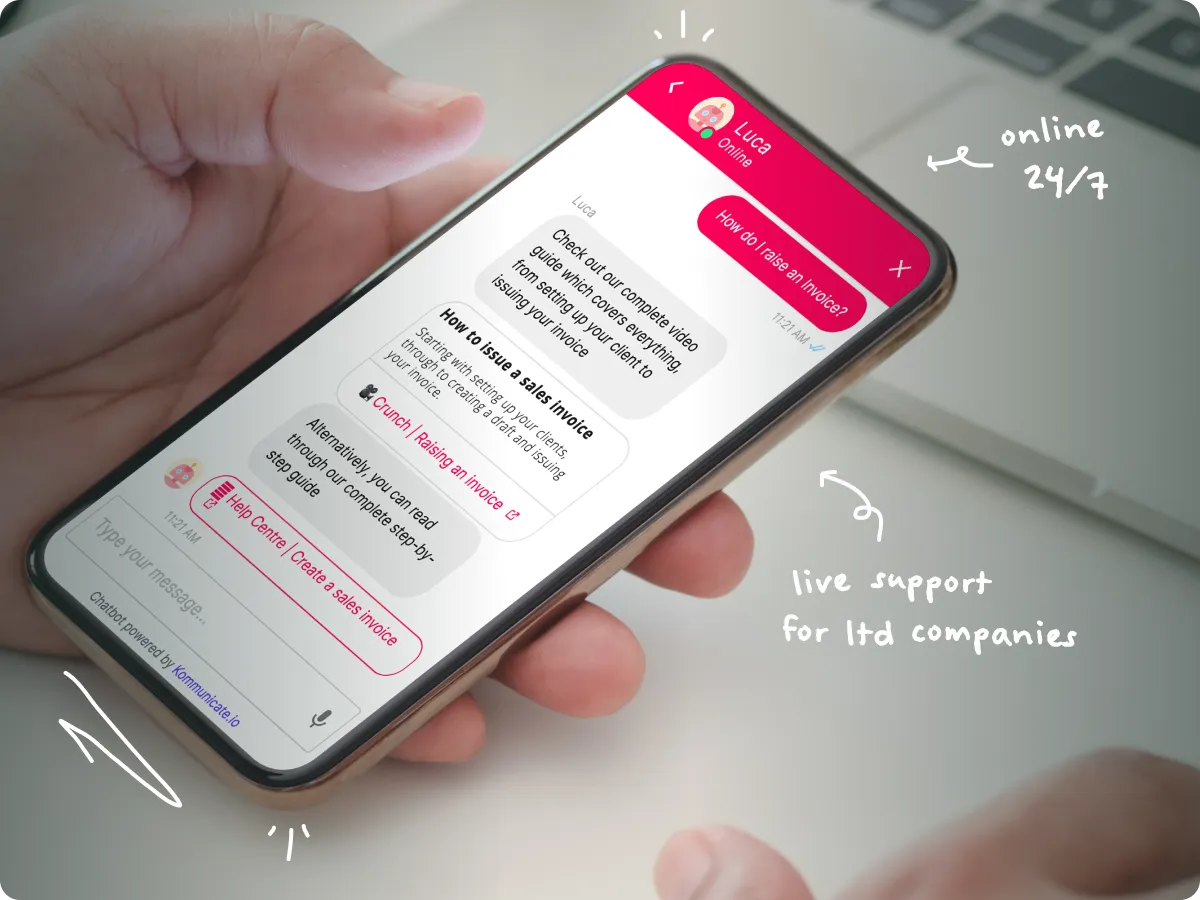

At Crunch, we make keeping on top of your business finances a breeze, with our superhero client managers, expert accountants and easy-to-use online accounting software. You can monitor the performance of your business at the click of a button, whenever you want and wherever you are, with a super-secure, cloud-based system.

UK tax allowances and tax rates

Despite those old adverts insisting that tax doesn’t have to be taxing, the sad truth is that it can often be brain-achingly complex. There’s bucket-loads of jargon to deal with, and one of the terms you’ll hear more frequently is the Personal Allowance.

Thankfully, the Personal Allowance is one element of accounting and tax that’s actually not that difficult to understand. Allow us to elaborate.

Tax-free Personal Allowance

You’ll sometimes hear the Personal Allowance referred to as your “tax-free allowance”, which probably describes it better.

The Personal Allowance is the amount you’re allowed to earn in a given tax year (tax years run from 6th April to 5th April) before you start paying Income Tax.

For employees, the Personal Allowance will be taken into account automatically when the employer runs their payroll through a scheme called Pay As You Earn (PAYE).

What is the Personal Allowance for the 2022/23 and 2023/24 tax years?

Tax-Free Personal Allowance and tax thresholds

The Tax-Free Personal Allowance remains at £12,570 for both 2022/23 and 2023/24 tax years:

You don’t receive any personal allowance when you earn over £125,140 for both 2022/23 and 2023/24 tax years.

Your Personal Allowance may be increased if you claim Marriage Allowance or Blind Person’s Allowance, and as shown in the table above, the Personal Allowance is reduced when your income is over £100,000.

How does the Personal Allowance affect the self-employed?

For sole traders, your Personal Allowance will be taken into account when HMRC calculates your tax liability when you file your annual Self Assessment.

Limited company directors will have to take their Personal Allowance into account when running their own payroll or – more likely – use a piece of payroll software that does it automatically just like Crunch’s online accountancy software does!

Usually, limited company directors pay themselves through a combination of a salary and dividends, making the most of their personal tax allowances. We explain all this in our article ‘How much should I take as a salary from my limited company?’.

The Personal Allowance is just one of many allowances and thresholds that might affect you. There are also annual tax allowances for individuals amounting to £1,000 each: one for self-employment trading income (sole trade) and known as the ‘trading allowance’, and one for income from a property business. The allowances aren’t available if you have such income from a private limited company.

The allowances mean that those with small amounts of income can simplify their personal tax arrangements in certain situations. If you have both types of income, you’ll get a £1,000 allowance for each instead of claiming sole trader business expenses.

We explain the allowances more and whether you should claim them in our article ‘Tax-free allowances on property and trading income‘.

Personal Savings Allowance

Most taxpayers have a Personal Savings Allowance (PSA). This is the maximum amount of income your savings can earn without being taxed, and is decided based on your total taxable income. You only pay tax on the interest that exceeds your PSA.

The PSA for the 2023/24 and 2022/23 tax years for basic rate taxpayers is £1,000. For higher rate taxpayers the allowance is £500. Additional rate taxpayers don’t have any PSA

For those on a lower income (below £12,570 in the 2023/24 and 2022/23 tax years), there’s another tax-free allowance you can get called the starting rate for savings income. This allows you to earn another £5,000 per year in savings interest and you won’t pay any tax on that income. For every pound you earn above this threshold, you lose a pound of savings allowance.

Marriage Allowance

In April 2015 the government introduced the Marriage Allownce policy which allows a couple to share unused personal allowance if one partner is a basic-rate taxpayer and the other doesn’t pay tax because their income is below the Personal Allowance threshold (ie. less than £12,570 in the 2023/24 and 2022/23 tax years).

Under the Marriage Allowance policy, the person who earns below the Personal Allowance threshold is able to transfer up to £1,387 of their 2023/24 Personal Allowance to the person paying the basic rate of tax (£1,260 for the 2022/23 tax year).

This is done by registering with HMRC, who will change your tax code. From then on the amount of Marriage Allowance you are eligible for will transfer to your spouse every year unless you cancel the arrangement.

If you don’t claim Marriage Allowance and you or your spouse were born before 6th April 1935, you may be able to claim Married Couple’s Allowance.

Blind Person's Allowance

Another way your Personal Allowance could increase is if you’re eligible for the Blind Person’s Allowance. If you meet the criteria, the additional allowance is added to your annual Personal Allowance (see above).

If you and your spouse or civil partner are both eligible, you’ll each get an allowance.

You can transfer your Blind Person’s Allowance to your spouse or civil partner if you don’t pay tax or earn enough to use all of your increased allowance.

Income Tax rates, tax bands, tax brackets, and tax thresholds for the 2023/24 and 2022/23 tax years

When your income rises above a tax threshold, you start to pay tax on that income at the higher tax band, sometimes referred to as a tax bracket. The effect of these marginal bands is that you will pay tax on any income at the relevant rate for income in that tax band (or tax bracket).

So, If your total income puts you into the 40% tax bracket for the year, you’d only pay 40% tax on the part of your earnings in that Income Tax band. For the rest of your earnings below the tax band, you’ll pay the relevant (lower) rate applicable to each tax band.

Making contributions into a personal pension scheme, or Gift Aid donations can reduce the amount of tax you pay.

If you or your partner receive Child Benefit, you may have to pay the High Income Child Benefit Charge (HICBC) if either of you have individual income over £50,000. This would be a tax charge equivalent to 1% of the Child Benefit you receive for every £100 of personal income between £50,000 and £60,000.

Note: The table below shows the percentage rates of Income Tax that apply to taxable income in the current and previous tax years. The amounts assume the individual is receiving the standard Personal Allowance for tax-free income of £12,570 in the 2023/24 and 2022/23 tax years. The Personal Allowance is reduced by £1 for every £2 earned over £100,000.

{{pt-ask-accountant}}

Scottish Income Tax Rates and Tax Thresholds

The Scottish Government operates a different income tax regime compared to the rest of the UK, with a lower starter rate and more tax bands and tax thresholds.

*Personal Allowance is £12,570

The above table assumes the individual is receiving the Personal Allowance for tax-free income of £12,570 in the 2023/24 and 2022/23 tax years. The Personal Allowance is reduced by £1 for every £2 earned over £100,000. This is the same as the rest of the UK. There’s more background to the Scottish Income Tax rates and how to see if you’re classed as a Scottish taxpayer in our ‘Scottish Income Tax Rates and how to check if it applies to you’ knowledge article.

UK Dividend tax rates, income, allowance, and tax thresholds

There are changes to dividend tax rates but no change to the Dividend Tax Allowance for dividend income between 2023/24 and 2022/23 tax years:

- The tax-free dividend allowance is £1,000

- Basic-rate taxpayers pay 8.75% in the 2023/24 and 2022/23 tax years

- Higher-rate taxpayers pay 33.75% in the 2023/24 and 2022/23 tax years

- Additional-rate taxpayers pay 39.35% in the 2023/24 and 2022/23 tax years.

Dividends are money paid (or returned) to shareholders from the profits made by a company. A company can only pay a dividend if it has made a profit, and the dividends a company pays out can’t be more than its available profits for the current and previous financial years (also known as accumulated profits).

If you receive dividend payments from a company you may have to pay tax personally on that income. If you don’t already complete a Self Assessment tax return, receiving dividends may mean you need to complete one. We have an article to help you see if you need to complete a Self Assessment, or you can speak to an accountant, call the HMRC helpline or use HMRC’s online service to check

You’ll need to declare the total dividend income you’ve received on your Self Assessment tax return, whether the dividends come from your own limited company or another company you hold shares in. The higher your income from dividends compared to the personal tax thresholds, the higher your dividend tax rate.

If you receive dividends from companies where you aren’t a director, and you don’t currently complete a Self Assessment you can either ask HMRC to change your tax code if you are paid through PAYE, or if the amount you receive is over £10,000, you will need to start completing a Self Assessment.

The dividend tax-rate you pay is based on your total income from all sources, not just on your dividend income. For more information about tax on dividends read our article “What are dividends and what tax do I pay on them?”

The tax-free dividend allowance only applies to income received from dividends. It’s intended to remove an element of double taxation as companies pay dividends out of taxed profits. As shown above, the dividend tax rates are also lower than the equivalent personal tax rates. For this reason, limited company directors often use a combination of salary and dividends to pay themselves tax-efficiently. You can find out more in our article ‘How much should I take as salary from my limited company?‘

There is no tax due on dividends received from shares held within an Individual Savings Account (ISA).

National Insurance rates

National Insurance bands and rates are some of the most confusing around – not least because things are different for employees, sole traders and limited company directors. We have an article to help you understand them – “Self-employed National Insurance explained”. National Insurance Contributions (NICs) are usually calculated weekly based on your earnings, rather than annually. We’ve included both in the table below.

Employee National Insurance contributions (Class 1)

You should only make National Insurance deductions on earnings above the lower earnings limit:

*Primary Threshold was £9,880 from 6 April 2022 to 5 July 2022. It then increased to £12,570 from 6 July 2022 creating an annualised figure of £11,980.

Employer National Insurance contributions

As an employer, you may be eligible to claim Employment Allowance to reduce the Employer's National Insurance bill. Our Knowledge article explains what the Employment Allowance is and if you can claim.

Self-employed National Insurance contributions

We’ve written an article all about self-employed National Insurance, including examples of how to calculate your National Insurance liability.

*Lower Profits Limit was £9,880 from 6 April to 5 July 2022. It then changed to £12,570 from 6 July 2022

Capital Gains Tax

Capital Gains Tax (CGT) is a tax on the profit made when you sell (or ‘dispose of’) something (an ‘asset’) that’s increased in value. It’s the gain you make that’s taxed, not the amount of money you receive, and you can calculate your capital gains tax online with us in a few simple steps. The tax rate you use depends on the total amount of your taxable income. Read our article “What is Capital Gains Tax” for more information.

There are complex rules around Capital Gains Tax so if you need more help please speak with an accountant.

The period allowed to pay any CGT on property sales to HMRC will be reduced to 30 days from the date of sale on or after 6th April 2020. The period is extended to 60 days if sold on or after 27th October 2021.

What if I need a payroll service?

Crunch can provide our clients with a payroll service for directors and employees. Our software will automatically calculate and file your payroll with HMRC and produce payslips for you to keep.

Our Real-Time Information (RTI) compliant payroll can be set up in minutes and meets all HMRC requirements, letting you expand your business safe in the knowledge that you’re staying compliant.

Crunch Pro package clients receive this service for up to two directors paid up to the relevant National Insurance threshold, which is £9,100 (£758.33 per month) in the 2023/24 and 2022/23 tax years.

Our Crunch Premium package includes payroll at any amount for up to four directors. If you need payroll for up to 10 employees then you’ll need to add our additional Payroll service to your Crunch package or look at our Crunch Small Business package.

Company tax rates

You can find out more about the taxes paid by companies in our "small business taxes" article.

.svg)

.jpg)