Pricing is one of the most important business decisions you’ll have to make. Whether you consider starting a small business to complement your income or launch the next big thing, you need a clear process to establish how much you should charge for your products and services.

Charge too little and you’ll leave some money on the table. Charge too much and you’ll find it challenging to sell. Simply put, you can’t have your pricing wrong, as it will impact almost every aspect of your business.

In this guide, we’ll break down the exact steps to follow in order to determine the right price whether you sell physical goods, digital products or services.

Here’s what we’ll cover in the following sections:

- Step 1: Know your costs

- Step 2: Add your profit margin

- Step 3: Test, learn and iterate

For a high-level summary of the article, feel free to watch the video we made on the topic:

Step 1: Know Your Costs

First and foremost, you need to consider all the costs involved in creating your product.

Let’s take an example. Let’s say you want to start making your own candles at home:

To make one candle, you’ll need:

- 500g (1lb) of soy wax (£1)

- 1oz of the fragrance of your choice (£1)

- Some wicks (£1)

- 1 container (£2)

So your total cost for making one candle is £5. In addition to the raw materials, there are other costs you need to consider before setting a price. Those are, for example:

- Production time: this is your hourly rate. Let’s say you want to make £10 per hour and it takes you half an hour to make one candle. This means your production time is worth £5.

- Packaging: you need to include anything that will be used in the packaging, whether it’s a box, an envelope or bubble wrap.

- Payment & Platform fees: don’t forget that for online transactions, you might be charged a transaction fee. For example, Etsy will charge c.15% per transaction

- Shipping: think about the weight and the size of the item, and whether you want to allow international shipping or simply focus on nationwide shipping.

If you’re offering a service rather than products, the approach isn’t too different.

As you don’t have tangible costs that you need to cover, you have greater flexibility. But the bad news is that there’s no formula-based pricing in this case.

In this scenario, there are two things you need to consider:

- Competition: check what competitors are pricing for similar services. You can do so simply by checking their websites or the marketplaces where they offer their services.

- Perceived value: this is where a lot of the subjectivity comes in when setting your price. You need to understand how much customers are willing to pay. You have multiple tools at your disposal, for example doing a survey on Instagram or sending an email to your existing customers.

Now that you know your costs, the only thing left in order to set your price is to add your desired profit margin. We’ll cover that in the next section.

Step 2: Add Your Profit Margin

You are now able to estimate how much it costs to make one unit of the product you’re selling. Or if you have a services business, you know how to value one hour of your time.

But the reality is that you don’t run a side hustle or a full-time business as a non-profit. You want to make some money out of it.

You need to set a target of how much profit you want to make each month, then estimate how many items you can sell, and therefore derive a profit per item.

Let’s say you want to make £500 per month. How many candles would you need to sell? Let’s assume that your total costs for making and selling a candle is £15.

If you sell each candle at £20, you’ll be making an extra £5 per candle you sell. So you’d need to sell 100 candles per month, or about 20 per week, to reach your earnings target.

Simple, right? There are two caveats you should keep in mind:

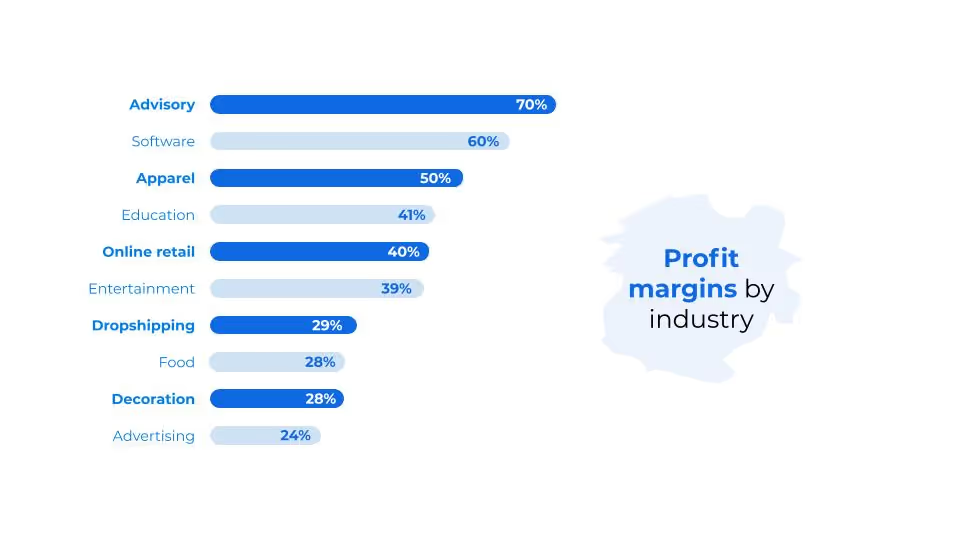

- Check industry averages. It would be too easy to just set a price that makes you happy. You need to set a price in line with your industry standards.

A profit margin is calculated as a percentage of your selling price. For our candle, the profit margin would be £5/£20=25%, exactly in line with the industry average.

- Check your price vs competition. No matter what you sell, you will likely face strong competition and your customers will definitely benchmark your products against others, so your price needs to be broadly in line with similar products.

There are two possible scenarios that allow you to set your own price, regardless of how much competition charges.

One option is to focus on higher-end products. For example, you can prioritise higher-quality raw materials in your candles, or focus on more expensive fragrances. This is a great way to make your products stand out especially in crowded markets.

The second option where you can set your own price is when you have a recognised brand. Let’s say you sell fitness classes. If you have an Instagram following of 500k, people will of course be willing to pay more for one hour of your time than if you’re just starting out.

This is why it’s so important to focus on your brand from day one, even if you’re just starting a side hustle. This will allow you to increase your margins in the future once you have an established brand.

{{ecommerce-guide}}

Step 3: Test, Learn and Iterate

The Test-Learn-Iterate loop is the best tool you can use to quickly test if a pricing strategy is working or not. This fundamental model allows you to quickly validate or invalidate your prices.

It works as follows:

- Test: apply the above-described methodology to come up with a price assumption for your products and services

- Learn: do not change the price of an item for at least a few months to give you enough visibility. See what your sales are

- Iterate: if you’re having a satisfactory level of sales for a given product, then all is good and you don’t need to do anything; if the price levels are too low, then lower the price by 10% and repeat the above action.

Don’t let fear hold you back from launching a new product. Pricing is an iterative process, so you’ll have to get used to adjusting your prices up and down.

As you grow and evolve, your costs, your customers or your competition can change and therefore, prices can seldom be set in stone for good.

As long as your price is enough to cover your expenses, you’re just testing what the right margin for your product is and you’re not threatening your business.

Keep talking to your customers to be aware of what’s going on and keep learning what price they are willing to pay!

This article was written in partnership with Stephane Koch of Shappy.

.svg)

.webp)