Crypto taxes made simple

Invest company funds in Bitcoin, without the headache

From purchasing Bitcoin with company funds to sorting your Year End accounts, we can keep your Bitcoin investments clean and stress-free. No more spreadsheet headaches or guessing what HMRC will ask for, we’ve got it covered.

Why are companies doing this?

Ever wonder what your profits could be doing instead of just sitting in the bank? More and more businesses are putting their retained funds to work in smarter ways, like:

- Making their money work harder instead of letting it gather dust.

- Growing company value without taking profits out (and paying extra personal tax).

- Balancing cash reserves with Bitcoin to diversify.

Crunch × Recap: company Bitcoin, done right

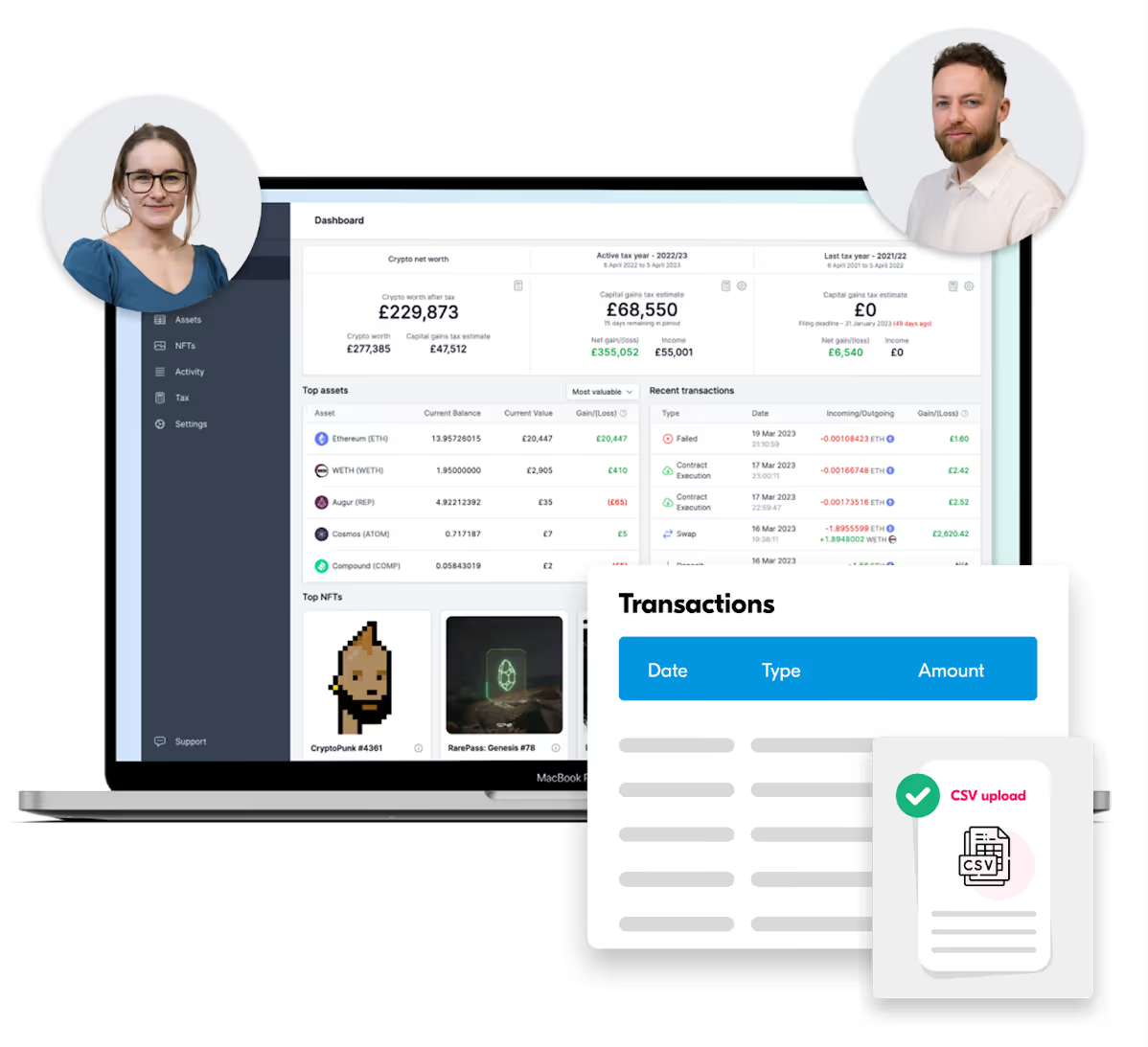

Investing company funds in Bitcoin doesn’t have to be complicated. Keeping records and preparing Year End accounts and Corporation Tax can be a headache. That’s why we’ve teamed up with Recap to make it stress free.

Recap keeps a clear, audit-ready record of what you hold, where it’s stored, and its GBP value. Crunch accountants review and post everything to keep your Corporation Tax and statutory accounts spot on. Simple, secure, and stress-free.

Why can’t you just “buy Bitcoin and move on”?

Once Bitcoin sits in your company, it’s officially a company asset. That means:

- Proper accounting is essential, even if you don’t sell.

- Selling triggers tax. So chargeable gains and Corporation Tax apply.

- Your board, bank, auditors, and HMRC will all want to see the numbers.

Crunch handles accounting and taxes, and Recap keeps the records clean and audit-ready.

.webp)

What you get with Crunch × Recap:

A clean audit trail

Know exactly what your company owns, where it’s held, and how it’s moved. So your books stay tidy and defensible.

Expert review at every step

Crunch’s ACCA-certified accountants check everything so your accounts are right the first time.

Correct Corporation Tax treatment

All Bitcoin activity is properly recorded and reported, so you pay what you should and nothing more.

Board, bank & HMRC ready reports

Clear, audit-ready records make it easy to answer questions and show that everything is above board.

Your Year End, sorted

Recap produces accountant-ready reports, and Crunch turns them into fully filed Year End accounts.

Security and privacy built in

With Recap’s data encryption and Crunch’s bank-grade security, your data is always protected.

%201.avif)

How it works

1. Plan and purchase

Decide how much Bitcoin your company will hold and get the board on the same page. Use a regulated exchange in the company’s name to keep things simple and your banking clean.

2. Secure and record

Choose where to store it safely, whether that’s your own secure wallet or a professional custodian. Recap keeps a clear record of what you bought and where it’s held, all without touching your private keys.

3. Report and file

At Year End, Recap creates the reports* you need, and Crunch takes care of the rest. We’ll post journals, prepare accounts, and file Corporation Tax. Everything you need to keep your board, bank, auditors, and HMRC happy.

Ready to invest in Bitcoin as a company?

Frequently asked questions

Explore our FAQs for quick answers to your questions

Recap gives you clear, accountant-ready reports that make company Bitcoin accounting simple:

- Balance Sheet Summary - shows exactly what your company holds, each assets costs, and its current value.

- Gains & Movements Report - details every sale and chargeable gain/loss so nothing slips through the cracks.

Crunch transforms your Recap reports into complete, compliant Year End accounts and Corporation Tax filings you can stand behind.

In simple terms, it’s anything your business owns that has value. When it comes to Bitcoin, things work a little differently. If you’re buying it through your company as an investment, it’s classed as an intangible asset. That means it isn’t treated like money in the bank or physical kit like a laptop. Instead, it sits on your balance sheet as something the business owns that doesn’t have a physical form. And when you eventually sell it, you’ll need to account for any gain or loss in your company’s accounts.

Yes, as long as it’s recorded properly. Crunch uses Recap’s data to make sure everything is accounted for and reported the right way.

Kraken and Bitstamp are known to work smoothly with automated tracking.

No, it stays within your company. Any gains are handled under Corporation Tax, not your personal Self Assessment.

It depends on your bank. Using an FCA-registered exchange, keeping good records, and having Recap’s audit trail usually keeps things running smoothly.

You can, but it’s more complex. Different cryptoassets come with different risks, accounting rules, and tax requirements, so Bitcoin is often the simplest option for company funds.

We don’t recommend it for a company treasury. It adds counterparty risk and potential loss of beneficial ownership, and complicates accounting and tax. And ultimately, it adds more costs.

A transaction is any trade, swap, transfer, or reward recorded by your exchange or wallet. Each one affects your Capital Gains, so keeping track is essential for accurate HMRC reporting.

Absolutely. We work entirely within Recap, a UK-based crypto tax platform that uses client-side encryption. That means your data is encrypted on your device before it’s shared, and you stay in full control of your information at all times.

Recap is the UK’s leading privacy-focused crypto tax software, built to take the stress out of crypto taxes. It keeps your data secure, helps you stay HMRC compliant, and makes managing your crypto easier than ever. And thanks to our partnership, you can use it alongside Crunch for a smoother, simpler experience.

Yes. All our in-house team of accountants are fully accredited and experienced in UK tax rules, regulations, and restrictions. They’ll review every detail of your company’s tax and look for ways to optimise wherever possible. With Crunch, you get accurate, compliant filings and peace of mind knowing experts are on your side.

A professional custodian is a company that securely holds and manages your Bitcoin or other digital assets on your behalf. Think of them as a safe, trusted third party that keeps your crypto secure, handles the technical details of storage, and ensures there’s a clear record for accounting and audit purposes. Using a custodian can be helpful if you don’t want to manage private keys yourself, or if your company just wants an extra layer of security and compliance for its digital assets.

A regulated exchange is a safe, official platform where your company can buy and sell Bitcoin. It keeps your transactions clear, legal, and easy to account for.

It means the firm is registered with the Financial Conduct Authority (FCA) under the UK Money Laundering Regulations for certain cryptoasset activities. This is not the same as full FCA authorisation under the Financial Services and Markets Act 2000, and it does not mean that cryptoassets themselves are regulated. Cryptoasset investments are high risk, and you are unlikely to have access to the Financial Ombudsman Service or the Financial Services Compensation Scheme in relation to cryptoasset activities.

.svg)