You live life.

We sort your accounts.

Juggling tax compliance, bookkeeping and budgets takes your focus away from growing your business. Crunch handles the financial back-office so you can operate stress-free.

Why choose Crunch?

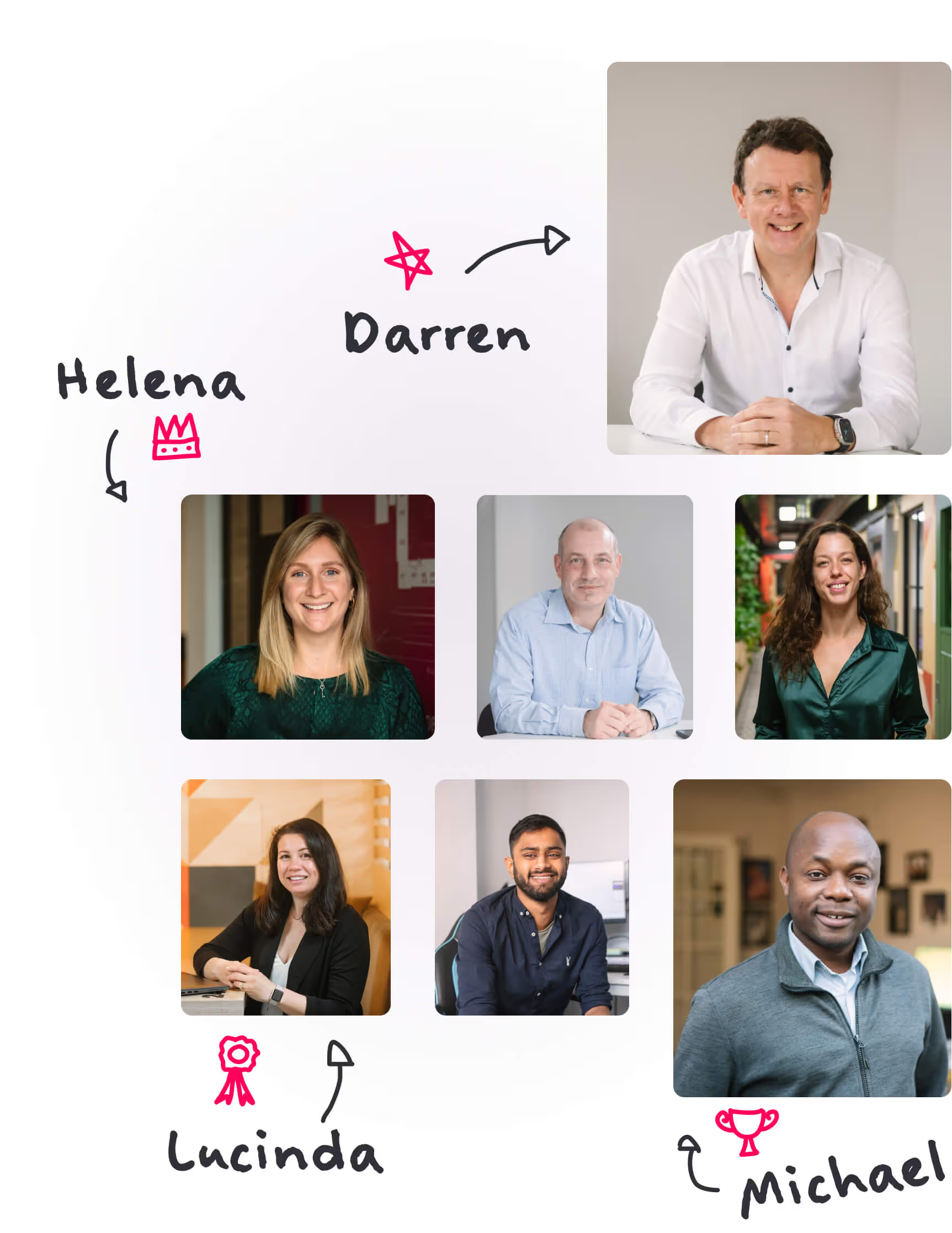

Meet the Crunch Accounting Team

At Crunch, we’ve got your back.

Not only do you get our award-winning software, but our team of super-friendly expert accountants is always here to help you out with unlimited advice on taxes, compliance, and financial planning.

We’re not just a service; we’re your partner in making sure your business shines!

Packed full of features

Expert Client Success Manager

Your UK based dedicated Client Success Manager will help you get started, and assist you no matter how small or large your accounting questions are.

More than just accounting

We do more than crunch your numbers. Whether that be additional bookkeeping support, mortgage brokers, payroll experts, tax experts or insurance, we’ve got you covered.

Limited Company accountants

When your Client Success Manager can’t help, our expert Limited Company accountants can, but there’s no clock ticking and consultation fee's racking up. It’s all included!

Crunch Live

Speak to your Client Success Manager or accountant quickly and efficiently via video. No fuss, less emails and your questions answered faster. Simple!

Rapid year-end accounts

Companies House allows nine months to file accounts after year-end but we do them in 8 weeks or less depending on your package. We have an express service if you need them faster.

Connect your bank account

Your banking feed connects your business bank account directly to your Crunch Limited Company accounting software and automatically imports all business transactions.

Cashflow & Corporation Tax liability

Our Limited Company accountancy packages provide you with real-time details of how much Corporation Tax to pay and indicate how much you can take in dividends.

Smart Pricing, Smarter Accounting

Why go Limited?

Choosing how best to set up your business is an important decision. Crunch are here to offer guidance and support.

Below are a few top benefits to setting up as a Limited Company.

Protection

Limited Companies separate you and your personal wealth & assets from any form of bankruptcy, litigation etc. There is much less protection offered to a sole trader or partnership.

Tax & National Insurance efficiency

Limited Companies are more tax-efficient from approximately £30,000 of annual profit. Speak to our expert team who can advise and guide you.

Reputation/Credibility

A Limited Company adds gravitas and authority to your business. The other benefit is that your clients can easily check the credit rating of a Limited Company, which helps to determine whether to work with you.

Easier access to finance

Setting up and financing a new venture is tricky. A Limited Company makes the process easier to access finance.

Crunch can form your business

We will cover the cost of your company formation when you sign up for a Crunch Pro, Crunch Premium or Crunch Small Business Limited Company accounting plan. Learn more about our Limited Company formations here.

Do you need more advice?

Consult one of our experts to advise and guide you through the pros and cons of setting up as a Limited Company, or indeed any of the Crunch services.

Frequently asked questions

Explore our FAQs for quick answers to your questions

No, as a Crunch Limited company accounting client, you don’t have to worry about any of it! We take care of all the complex registrations and key filings for you. From VAT to PAYE, RTI to Self Assessments, we can handle the whole process so you don’t have to face the daunting world of tax yourself. Without Crunch, you’d be left navigating a sea of paperwork, tight deadlines, and the risk of missing something important. But with us, you’re in safe hands.

Missing your Limited company filing deadline can lead to penalties, interest charges, and potentially a late filing notice. HMRC and Companies House are strict with deadlines, and failing to file on time can affect your business reputation. With Crunch, you’ll never miss a deadline, as we handle everything for you, keeping track of your filings and ensuring timely submissions.

Absolutely! Our expert Limited company accountants can help you with tax planning strategies to ensure you're taking advantage of any allowances, deductions, and tax reliefs available to your business. We take a proactive approach to help you reduce your tax liabilities and ensure your business is tax-efficient.

As a Crunch client, you’ll be able to get a complete overview of what tax you owe with our real-time dashboard, giving you a clear and instant picture of your business finances. You’ll also be able to access all of your limited company records, such as your expense receipts, sales invoices - whether paid or unpaid - and records of your previous tax filings.

You must keep records for six years from the end of the last company financial year they relate to, or longer, if:

- they show a transaction that covers more than one of the company’s accounting periods

- the company has bought something that it expects to last more than six years, like equipment or machinery

- you submitted your Company Tax Return late

- HMRC has started a compliance check into your Company Tax Return.

Check out our Knowledge article, “How long should company records be retained for?”, for more information!

Your Limited company will need to prepare and submit accounts to Companies House and HMRC. Using Crunch’s accounting software can simplify this process. We ensure your business is compliant with Making Tax Digital and help streamline your tax returns with secure, organised record-keeping.

For tax efficiency, many Limited company directors choose to pay themselves a combination of salary and dividends. This method minimises National Insurance and allows for tax-efficient withdrawals. We can advise you on the best approach for your business and financial goals. Alternatively, check out our guide for more information.

As a Limited company, you may need to pay a variety of taxes, including Corporation Tax, VAT, and National Insurance. Crunch’s Limited company accountants can guide you through your tax responsibilities and ensure you're meeting deadlines while optimising your tax savings.

You must file your Limited company accounts with Companies House within nine months of your accounting period's end. Additionally, your Corporation Tax return must be submitted to HMRC within 12 months. Crunch’s team will ensure you stay compliant with deadlines.

As the director of your limited company, you are responsible for authorising your tax returns. Crunch can help you prepare some of your returns, and even file them for you, but the responsibility for signing them off is ultimately yours!

There are complex rules surrounding the type of company which must have an audit. You can find out more if you check HMRC’s website. In general terms, if your company’s turnover is below £10.2 million, and its assets are below £5.1 million, you do not need to have an audit. However, some companies with turnover and assets below these amounts elect to have an audit to comply with financial covenants.

You’ll need to include every business bank transaction that relates to your limited company to ensure your accounts remain in balance and you can reconcile them at year-end.With secure Open Banking connections, you can link your business bank account directly to your Crunch account and import all of your transactions in one simple click. From there, reconciling your bank accounts becomes a simple job!

Whether you're a small business or a growing enterprise, there's no legal obligation for a Limited company to have an accountant. However, as a limited company director, your legal responsibilities and tax obligations make having an accountant a smart choice. A good accountant can help you stay on top of your finances, submit tax returns, and free up your time to focus on growing your business. At Crunch, we make it easy with our expert team, dedicated to simplifying tax filings and saving you time.

At Crunch, we’re easy to reach, no matter your preferred method of communication. Whether you’re a small business or a growing company, you’ll always have access to real humans who are ready to help. Whether by phone, video call, live chat, or email. And soon, you’ll even be able to reach us via WhatsApp! We know your time is valuable, so we make sure getting in touch with your accountant or client manager is quick and hassle-free. No long call queues or endless email chains—just fast, expert support when you need it!

At Crunch, we offer Limited company accounting from just £2 + VAT per month for the first 3 months, then £90 + VAT p/m thereafter. For this, you get access to a whole team of expert Limited company accountants and client managers who can help you manage your business finances, tax responsibilities, and so much more!If you’re happy managing your own accounts, or you have your own accountant already, you can sign up to a Crunch Free account to help you organise your expenses, sales invoices, and other important records.

Still have questions?

Helpful Limited Company resources

Looking for limited company advice and guidance before paying for our service? We've got you covered.

Connect your bank account

_logo.svg)

Trusted by 64,000+ businesses and counting...

Who We Help

Architects

Contractors

Creative freelancers

Dentists

Freelancers

Interior designers

IT consultants

Online retailers

Plumbers

Startups

Switching accountants

Whatever your passion is...

HMRC recognised. Trusted chartered certified accountants

Trusted by thousands, backed by experts—our award-winning service speaks for itself.

Award-winning pay monthly online accountancy

Expert Accountants

We are ACCA Chartered Certified Accountants, meaning you always get the best advice.

Easy-to-use

By developing our own software, we have created a highly efficient way of supporting you better.

Affordable Prices

Our efficiency and scalability means we can pass the savings to you!

Why choose Crunch? We know what it's like to run a business, so we have created the best online accounting solution for you. Join over 40,000 people who are already using Crunch. A monthly rolling subscription, with no long term contracts, and upgradable at any time.

Who Are...

In 2007, entrepreneur Darren Fell had enough of the many shortfalls of traditional accountancy firms. So, he grabbed the bull by the horns and created a fairly priced, all-inclusive service for freelancers, contractors, and small businesses, bringing together easy-to-use online accounting software with in-house support when you need it.

.svg)